R&D Tax Changes 2025. These extensive changes to the r&d tax relief rules will affect the vast majority of r&d claimants. As of april 2025, the two separate rdec and sme tax credit schemes will be merged, both to streamline the relief and help control its overall cost.

The internal revenue service (irs) is proposing revisions to form. The tax relief for american families and workers act of 2025 has been advanced to the house floor.

R&D Tax Credit Explained National Referral Network, Updated guidance on r&d expenditures: Merger of current small or medium.

R&D Tax Relief Changes Overview ForrestBrown, The internal revenue service (irs) is proposing revisions to form. There is also a new above the line tax credit system for film,.

R&D Tax Reforms What’s changed? Azets UK, Merger of current small or medium. Research & development (r&d) tax relief reforms.

Are You Eligible For R&D Tax Credit? Find out using this infographic, There have been a series of significant r&d tax relief changes that came into effect for accounting periods starting on or after 1 st april 2025, with. As of april 2025, the two separate rdec and sme tax credit schemes will be merged, both to streamline the relief and help control its overall cost.

Tax Brackets 2025 Irs Table Ronni Tommie, The section 41 r&d tax credit reporting requirements: Ottawa — finance minister chrystia freeland intends to ask parliament to approve proposed changes to capital gains tax rates in a.

Tax rates for the 2025 year of assessment Just One Lap, It is applicable for claims for accounting periods which commence after 1 april 2025. The internal revenue service (irs) is proposing revisions to form.

tax drop to 19 in 2025 brought forward to 2025 and then, Merger of current small or medium. As of april 2025, the two separate rdec and sme tax credit schemes will be merged, both to streamline the relief and help control its overall cost.

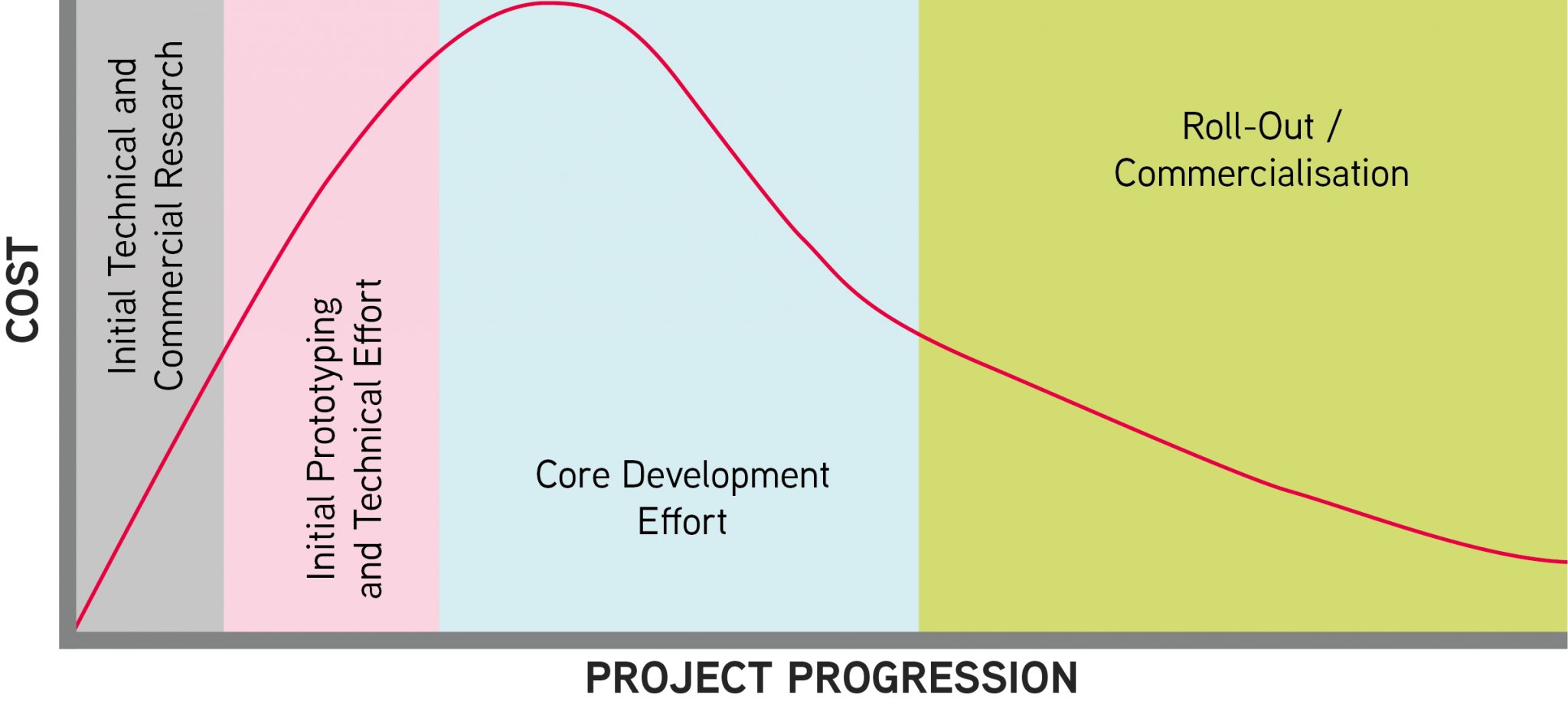

Can you claim R&D Tax for New Product Development? TBAT Innovation, As of april 2025, the two separate rdec and sme tax credit schemes will be merged, both to streamline the relief and help control its overall cost. Proposed changes to form 6765 credit for increasing.

2025 Tax Brackets Vs 2025 Presidential Lanae Miranda, It is applicable for claims for accounting periods which commence after 1 april 2025. The current rdec and sme regimes will be merged and there will also be an enhanced.

UK iTax R&D Tax Incentives, benefits, claims, eligibility, The internal revenue service (irs) is proposing revisions to form. What taxpayers need to know for 2025 and beyond.

Major changes to the research & development (r&d) tax credit could be coming for tax years starting in 2025, as the irs has proposed adjustments to form.